New Polish Order – what plans does the Polish entrepreneur have?

A new government project aimed at Polish entrepreneurs will come into force as of July 2021. Already the project assumptions of the New Polish Order face considerable criticism not only from entrepreneurs but also from specialists in the field of economics.

The program significantly increases the tax burden on people in the middle class. Thus, the most vulnerable to any inconvenience is first of all small and medium entrepreneurs. So how is this social group going to cope with the new government assumptions?

Among the changes that the government is preparing for the Polish entrepreneurs, there is i.a. the increase of the PIT free amount for the lowest-earning citizens with the simultaneous increase of the second PIT threshold. The rules of calculating the health contribution are also to be changed. The draft also mentions a relief for the middle class, but so far no specific information has been given.

New Polish order – we know the government’s tax guidelines

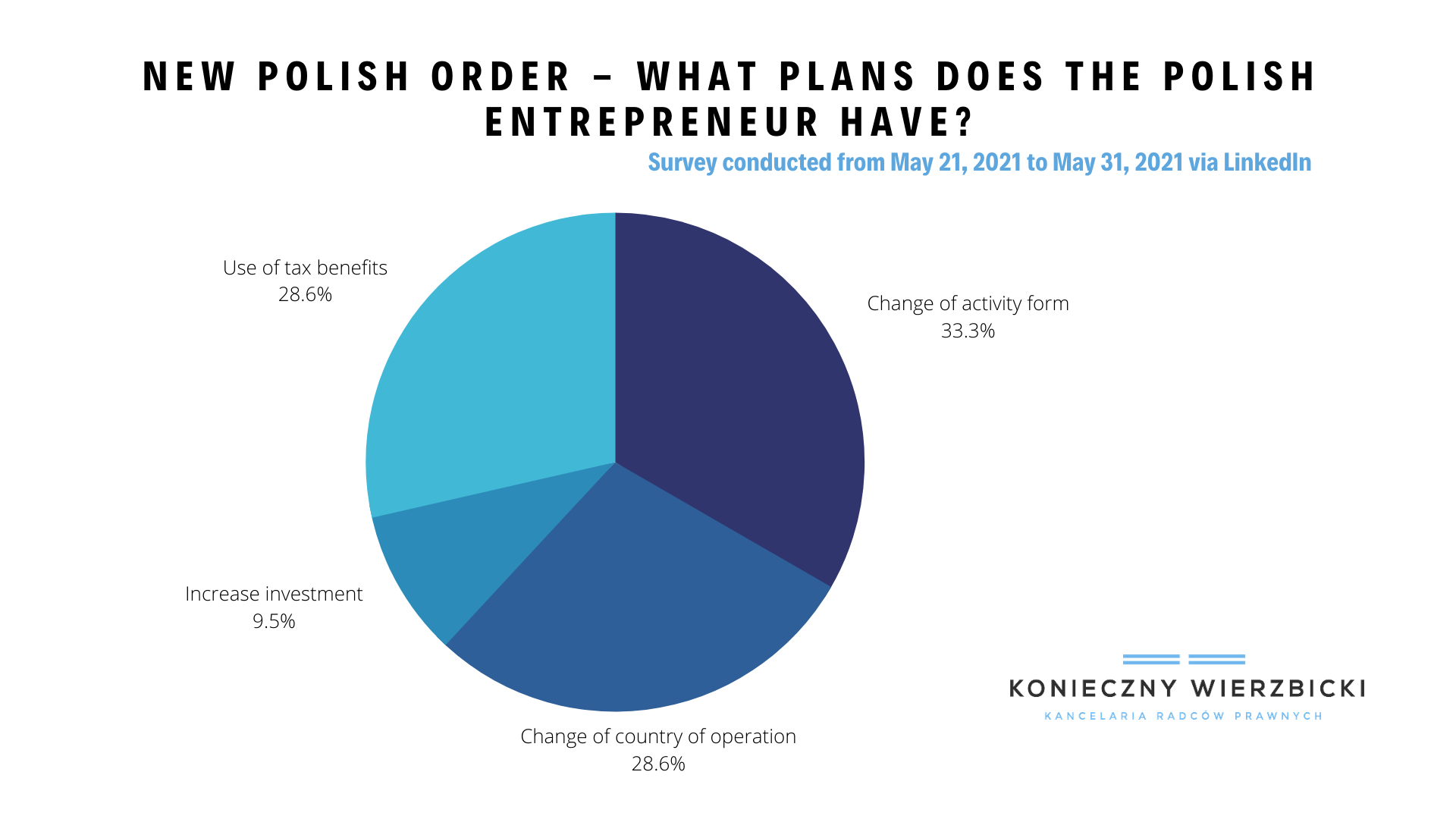

So how do Polish entrepreneurs react to the changes? In a survey conducted by our law firm, most persons (33.3%) plan to change their form of business. 28.6% of respondents are considering a change in the way they run their business, the same number of people are likely to take advantage of tax reliefs. On the other hand, the least (9.5%) are willing to increase investments.

Perhaps some entrepreneurs will change their plans once the details of the government program become known.